Figuring depreciation on rental property

How To Calculate Depreciation On A Rental Property. This means that you deduct 1275 of the purchase price of the building onlynot the landevery year.

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

Annual Depreciation Purchase Price - Land Value.

. For instance if a rental property with a cost basis of 308000 were first placed in service in. This calculation is based on the month the rental property was placed in service. When you sell your home that you have lived in and owned for more than two years within the last five years you get to exclude.

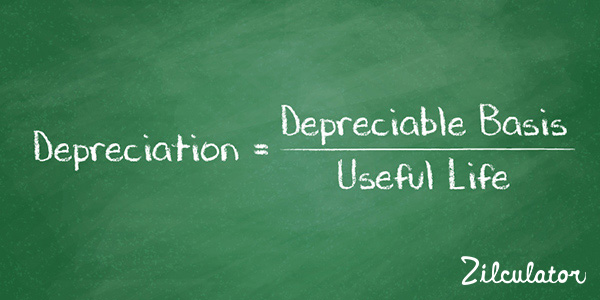

Occupancy of real estate. How to Calculate Rental Property Depreciation Property depreciation is calculated using the straight line depreciation formula below. The rental property depreciation process has four basic steps that include determining the cost basis of your.

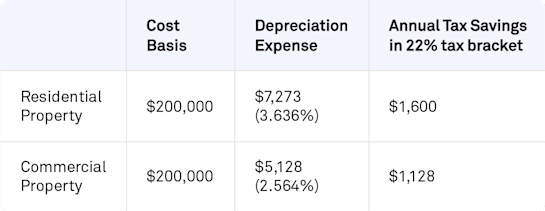

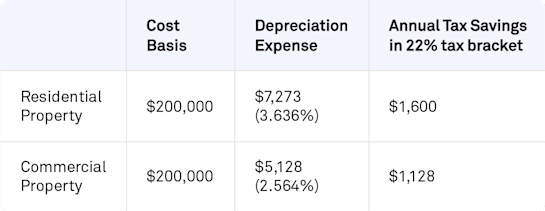

If you own a 200000 rental. There is a special rule for property that was used for personal purposes before converting it to a rental property. How do you calculate depreciation on a rental property.

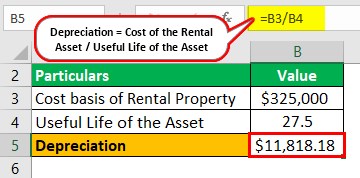

To calculate the annual amount of depreciation on a property you divide the cost basis by the propertyÕs useful life. For a married couple filing jointly with a taxable income of 280000 and capital gains of. Depreciation expense Actual value of the property divided by 275 years.

The basis of the rental property is whatever price you paid for it. How to Calculate Depreciation on Rental Property for Taxes. Use of personal property.

If that is the case the basis for depreciation is the lesser of. As for the residence itself the IRS requires. For residential property the federal depreciation period is 275 years.

Amounts received from tenants for the monthly rent of property. Calculate the basis of your rental property. Rental income is money you receive for the.

The IRS permits rental property owners to deduct a set percentage of the propertys cost basis from the taxes owed on the generated income over the useful life of the. The building is depreciable over 275 years. Discover The Answers You Need Here.

If your taxable income is 496600 or more the capital gains rate increases to 20. Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in annual depreciation expenses. To calculate your depreciation expense heres the formula.

How To Use Rental Property Depreciation To Your Advantage

How To Calculate Rental Income The Right Way Smartmove

Financial Accounting Ifrs 3rd Edition Pdf Google Drive Financial Accounting Accounting Financial

Depreciation For Rental Property How To Calculate

Self Employment Ledger Forms Best Of Self Employment Ledger 40 Free Templates Examples Self Employment Templates Free Design Template Free

Self Employment Ledger Forms Best Of Self Employment Ledger 40 Free Templates Examples Self Employment Templates Free Design Template Free

Understanding Rental Property Depreciation 2022 Bungalow

/GettyImages-1056502202-b3fba961eb6c42b68fe6bf0c68bc977f.jpg)

How To Calculate Rental Property Depreciation

Rental Income And Expense Worksheet Propertymanagement Com

Straight Line Depreciation Calculator And Definition Retipster

How To Calculate Depreciation On Rental Property

Depreciation For Rental Property How To Calculate

Depreciation Recapture What It Is How To Avoid It In 2022 Capital Gains Tax Irs Taxes Savings Strategy

How To Calculate Depreciation On A Rental Property

How To Calculate Depreciation Expense For Business Online Accounting Software Accounting Books Business

Real Estate Depreciation Meaning Examples Calculations

Expense And Profit Spreadsheet Profit And Loss Statement Budget Spreadsheet Statement Template